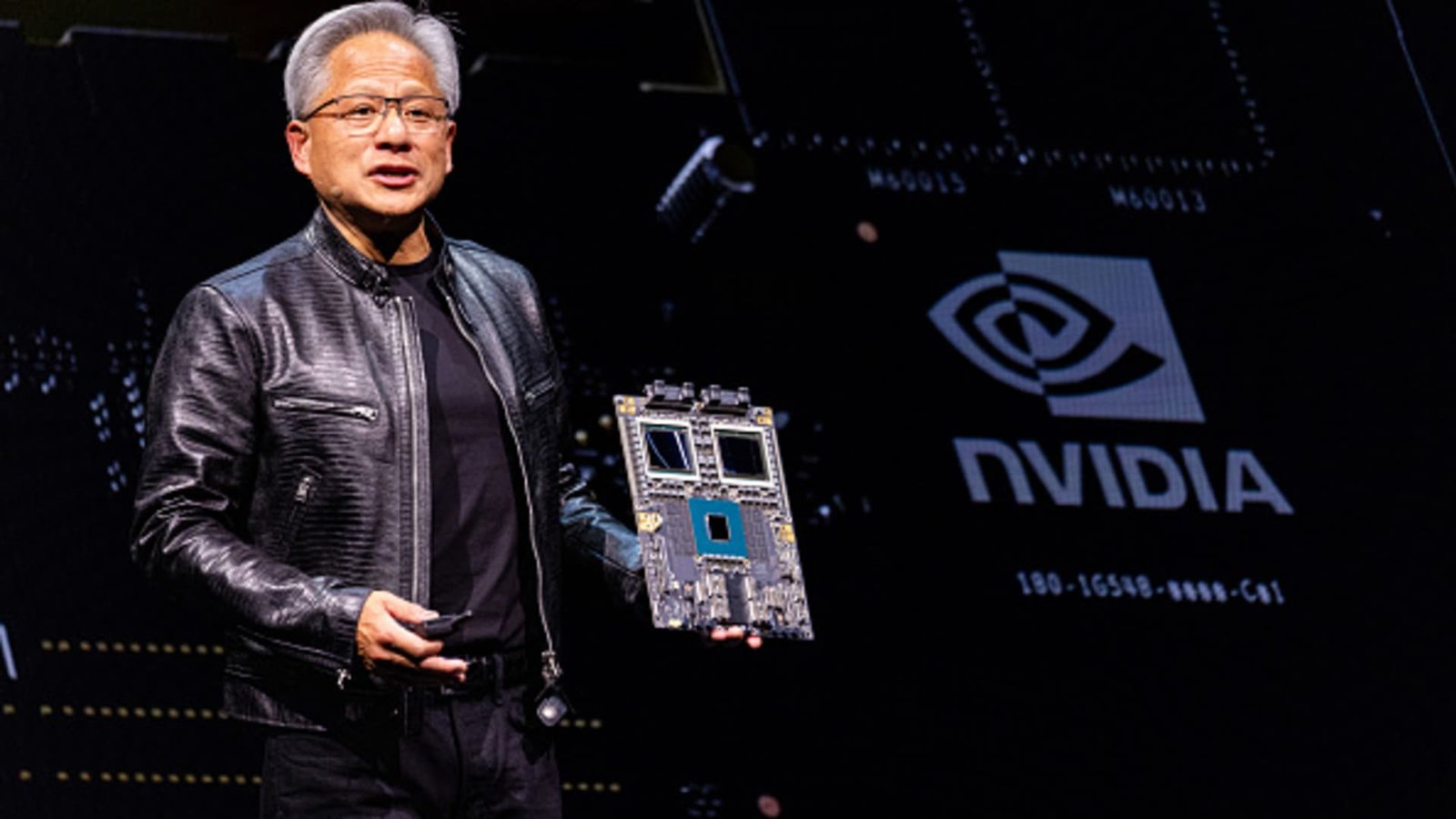

Jensen Huang, co-founder and CEO of Nvidia, speaks throughout an occasion in Taipei, Taiwan, on June 2, 2024.

Annabelle Chih | Bloomberg | Getty Photos

Shares of Nvidia rose to a brand new file on Thursday as buyers piled again in to the factitious intelligence commerce that had stalled a bit because the summer time. The inventory rose greater than 3% at one level to briefly faucet a brand new intraday excessive of $140.89.

The brand new excessive bested a earlier file of $140.76, which was set on June 20. Shares had been buying and selling at about $139.59 as of 10.26 a.m. ET.

Nvidia, 5 years

Nvidia’s intraday file comes after Taiwan Semiconductor Manufacturing Company, the world’s largest chip producer, beat third-quarter earnings estimates and posted a 54% enhance in revenue. The corporate produces chips for firms like Apple, Nvidia, AMD and ARM.

Nvidia inventory hit a closing high of $138.07 earlier in the week, topping its prior file of $135.58 set on June 18. Shares are up 180% year-to-date and have elevated greater than nine-fold because the starting of 2023.

Corporations together with Microsoft, Meta, Google and Amazon are buying Nvidia GPUs in huge portions to construct more and more massive clusters of computer systems for his or her superior AI work. These firms are all slated to report quarterly outcomes by the top of October.

Nvidia recently said demand for its next-generation AI GPU referred to as Blackwell is “insane” and it expects billions of {dollars} in income from the brand new product within the fourth quarter.

—CNBC’s Kif Leswing contributed to this report.