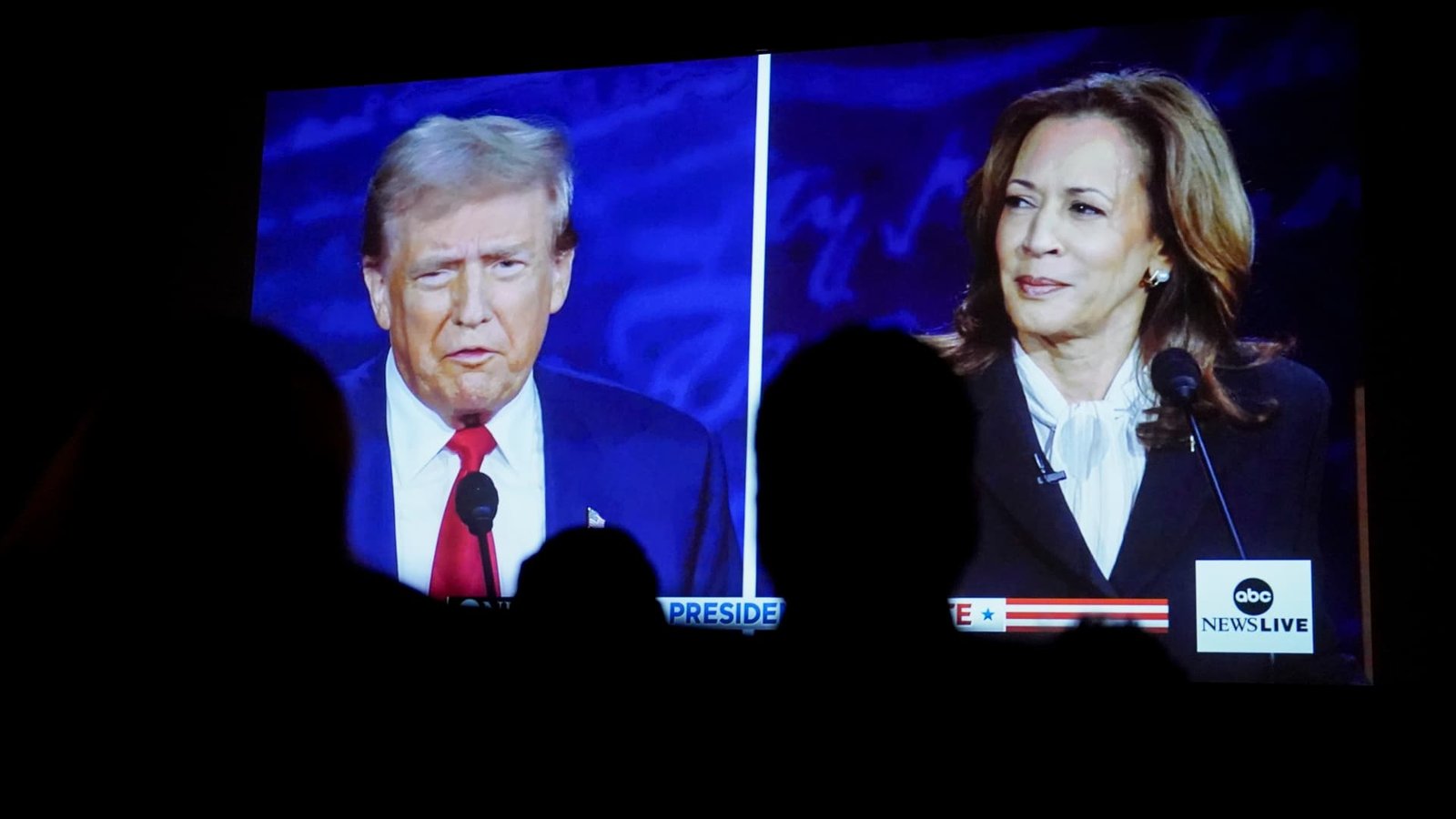

Former President Donald Trump and Vice President Kamala Harris face off within the ABC presidential debate on Sept. 10, 2024.

Getty Pictures

With the U.S. election lower than a month away, the nation and its companies are staring down two drastically totally different choices.

For airways, banks, electrical car makers, health-care corporations, media corporations, eating places and tech giants, the end result of the presidential contest might lead to stark variations within the guidelines they’re going to face, the mergers they’re going to be allowed to pursue, and the taxes they’re going to pay.

Throughout his final time in energy, former President Donald Trump slashed the company tax charge, imposed tariffs on Chinese language items, and sought to chop regulation and pink tape and discourage immigration, concepts he is anticipated to push once more if he wins a second time period.

In distinction, Vice President Kamala Harris has endorsed hiking the tax rate on companies to twenty-eight% from the 21% charge enacted underneath Trump, a transfer that will require congressional approval. Most enterprise executives count on Harris to broadly proceed President Joe Biden‘s insurance policies, together with his conflict on so-called junk fees throughout industries.

Personnel is coverage, because the saying goes, so the ramifications of the presidential race will not turn into clear till the winner begins appointments for as many as a dozen key our bodies, together with the Treasury, Justice Division, Federal Commerce Fee, and Client Monetary Safety Bureau.

CNBC examined the stakes of the 2024 presidential election for a few of company America’s greatest sectors. This is what a Harris or Trump administration might imply for enterprise:

Airways

The results of the presidential election might have an effect on every part from what airways owe shoppers for flight disruptions to how a lot it prices to construct an plane in the US.

The Biden Division of Transportation, led by Secretary Pete Buttigieg, has taken a tough line on filling what it considers to be holes in air traveler protections. It has established or proposed new guidelines on points together with refunds for cancellations, household seating and service charge disclosures, a measure airways have challenged in court docket.

“Who’s in that DOT seat issues,” stated Jonathan Kletzel, who heads the journey, transportation and logistics follow at PwC.

The present Democratic administration has additionally fought trade consolidation, profitable two antitrust lawsuits that blocked a partnership between American Airlines and JetBlue Airways within the Northeast and JetBlue’s now-scuttled plan to purchase funds provider Spirit Airlines.

The earlier Trump administration did not pursue these forms of shopper protections. Business members say that underneath Trump, they might count on a extra favorable setting for mergers, although 4 airways already management greater than three-quarters of the U.S. market.

On the aerospace aspect, Boeing and the tons of of suppliers that help it are in search of stability greater than the rest.

Trump has stated on the marketing campaign path that he helps extra tariffs of 10% or 20% and better duties on items from China. That might drive up the price of producing plane and different parts for aerospace corporations, simply as a labor and abilities scarcity after the pandemic drives up bills.

Tariffs might additionally problem the trade, in the event that they spark retaliatory taxes or commerce boundaries to China and different nations, that are main consumers of plane from Boeing, a prime U.S. exporter.

Banks

Huge banks comparable to JPMorgan Chase confronted an onslaught of recent guidelines this yr as Biden appointees pursued probably the most important slate of rules because the aftermath of the 2008 monetary disaster.

These efforts threaten tens of billions of {dollars} in trade income by slashing charges that banks impose on bank cards and overdrafts and radically revising the capital and danger framework they function in. The destiny of all of these measures is in danger if Trump is elected.

Trump is anticipated to appoint appointees for key monetary regulators, together with the CFPB, the Securities and Change Fee, the Workplace of the Comptroller of the Forex and Federal Deposit Insurance coverage Company that might lead to a weakening or killing off utterly of the myriad guidelines in play.

“The Biden administration’s regulatory agenda throughout sectors has been very formidable, particularly in finance, and enormous swaths of it stand to be rolled again by Trump appointees if he wins,” stated Tobin Marcus, head of U.S. coverage at Wolfe Analysis.

Financial institution CEOs and consultants say it might be a reduction if features of the Biden period — an aggressive CFPB, regulators who discouraged most mergers and elongated occasions for deal approvals — have been dialed again.

“It definitely helps if the president is Republican, and the percentages tilt extra favorably for the trade if it is a Republican sweep” in Congress, stated the CEO of a financial institution with practically $100 billion in property who declined to be recognized talking about regulators.

Nonetheless, some observers level out that Trump 2.0 may not be as pleasant to the trade as his first time in workplace.

Trump’s vice presidential decide, Sen. JD Vance, of Ohio, has usually criticized Wall Avenue banks, and Trump final month started pushing an thought to cap bank card rates of interest at 10%, a transfer that if enacted would have seismic implications for the trade.

Bankers additionally say that Harris will not essentially cater to conventional Democratic Social gathering concepts which have made life more durable for banks. Except Democrats seize each chambers of Congress in addition to the presidency, it could be tough to get company heads authorised in the event that they’re thought of partisan picks, specialists observe.

“I’d not write off the vp as somebody who’s robotically going to go extra progressive,” stated Lindsey Johnson, head of the Client Bankers Affiliation, a commerce group for giant U.S. retail banks.

— Hugh Son

EVs

Electrical automobiles have turn into a polarizing problem between Democrats and Republicans, particularly in swing states comparable to Michigan that depend on the auto trade. There may very well be main adjustments in rules and incentives for EVs if Trump regains energy, a proven fact that’s positioned the trade in a short lived limbo.

“Relying on the election within the U.S., we might have mandates; we might not,” Volkswagen Group of America CEO Pablo Di Si stated Sept. 24 throughout an Automotive Information convention. “Am I going to make any choices on future investments proper now? Clearly not. We’re ready to see.”

Republicans, led by Trump, have largely condemned EVs, claiming they’re being compelled upon shoppers and that they are going to spoil the U.S. automotive trade. Trump has vowed to roll again or eradicate many car emissions requirements underneath the Environmental Safety Company and incentives to advertise manufacturing and adoption of the automobiles.

If elected, he is additionally anticipated to resume a battle with California and different states who set their very own car emissions requirements.

“In a Republican win … We see increased variance and extra potential for change,” UBS analyst Joseph Spak stated in a Sept. 18 investor observe.

In distinction, Democrats, together with Harris, have traditionally supported EVs and incentives comparable to these underneath the Biden administration’s signature Inflation Reduction Act.

Harris hasn’t been as vocal a supporter of EVs recently amid slower-than-expected shopper adoption of the automobiles and shopper pushback. She has stated she doesn’t help an EV mandate such because the Zero-Emission Vehicles Act of 2019, which she cosponsored throughout her time as a senator, that will have required automakers to promote solely electrified automobiles by 2040. Nonetheless, auto trade executives and officers count on a Harris presidency could be largely a continuation, although not a replica, of the previous 4 years of Biden’s EV coverage.

They count on some potential leniency on federal gas financial system rules however minimal adjustments to the billions of {dollars} in incentives underneath the IRA.

Well being care

Each Harris and Trump have known as for sweeping adjustments to the expensive, difficult and entrenched U.S. health-care system of docs, insurers, drug producers and middlemen, which prices the nation more than $4 trillion a yr.

Regardless of spending extra on well being care than some other rich nation, the U.S. has the bottom life expectancy at start, the best charge of individuals with a number of power ailments and the best maternal and toddler loss of life charges, in response to the Commonwealth Fund, an impartial analysis group.

In the meantime, roughly half of American adults say it’s tough to afford health-care prices, which may drive some into debt or cause them to delay essential care, in response to a Might poll carried out by well being coverage analysis group KFF.

Each Harris and Trump have taken purpose on the pharmaceutical trade and proposed efforts to decrease prescription drug costs within the U.S., that are nearly three times higher than these seen in different nations.

However a lot of Trump’s efforts to decrease prices have been short-term or not instantly efficient, well being coverage specialists stated. In the meantime, Harris, if elected, can construct on present efforts of the Biden administration to ship financial savings to extra sufferers, they stated.

Harris particularly plans to expand certain provisions of the IRA, a part of which goals to decrease health-care prices for seniors enrolled in Medicare. Harris forged the tie-breaking Senate vote to move the regulation in 2022.

Her marketing campaign says she plans to increase two provisions to all People, not simply seniors: a $2,000 annual cap on out-of-pocket drug spending and a $35 restrict on month-to-month insulin prices.

Harris additionally intends to accelerate and develop a provision permitting Medicare to immediately negotiate drug costs with producers for the primary time. Drugmakers fiercely oppose these worth talks, with some difficult the hassle’s constitutionality in court docket.

Trump hasn’t publicly indicated what he intends to do about IRA provisions.

A few of Trump’s prior efforts to decrease drug costs “did not actually come into fruition” throughout his presidency, in response to Dr. Mariana Socal, a professor of well being coverage and administration on the Johns Hopkins Bloomberg Faculty of Public Well being.

For instance, he deliberate to use executive action to have Medicare pay not more than the bottom worth that choose different developed nations pay for medication, a proposal that was blocked by court docket motion and later rescinded.

Trump additionally led a number of efforts to repeal the Reasonably priced Care Act, together with its expansion of Medicaid to low-income adults. In a campaign video in April, Trump stated he was not operating on terminating the ACA and would relatively make it “a lot, significantly better and much much less cash,” although he has supplied no particular plans.

He reiterated his perception that the ACA was “awful well being care” throughout his Sept. 10 debate with Harris. However when requested he didn’t provide a alternative proposal, saying solely that he has “ideas of a plan.”

Media

High of thoughts for media executives is mergers and the trail, or lack thereof, to push them by.

The media trade’s state of turmoil — shrinking audiences for conventional pay TV, the slowdown in promoting, and the rise of streaming and challenges in making it worthwhile — means its corporations are sometimes talked about in discussions of acquisitions and consolidation.

Whereas a merger between Paramount Global and Skydance Media is ready to maneuver ahead, with plans to shut within the first half of 2025, many in media have stated the Biden administration has broadly chilled deal-making.

“We simply want a chance for deregulation, so corporations can consolidate and do what we have to do even higher,” Warner Bros. Discovery CEO David Zaslav stated in July at Allen & Co.’s annual Solar Valley convention.

Media mogul John Malone just lately advised MoffettNathanson analysts that some offers are a nonstarter with this present Justice Division, together with mergers between corporations within the telecommunications and cable broadband house.

Nonetheless, it is unclear how the regulatory setting might or would change relying on which get together is in workplace. Disney was allowed to accumulate Fox Corp.’s property when Trump was in workplace, however his administration sued to dam AT&T’s merger with Time Warner. In the meantime, underneath Biden’s presidency, a federal decide blocked the sale of Simon & Schuster to Penguin Random Home, however Amazon’s acquisition of MGM was authorised.

“My sense is, whatever the election consequence, we’re more likely to stay in an analogous tighter regulatory setting when taking a look at media trade dealmaking,” stated Marc DeBevoise, CEO and board director of Brightcove, a streaming expertise firm.

When main media, and even tech, property change arms, it might additionally imply elevated scrutiny on these in management and whether or not it creates bias on the platforms.

“General, the federal government and FCC have at all times been most involved with having a variety of voices,” stated Jonathan Miller, chief govt of Built-in Media, which makes a speciality of digital media funding.

“However then [Elon Musk’s purchase of Twitter] occurred, and it is clearly exhibiting you possibly can skew a platform to not simply what the enterprise wants, however to possibly your private strategy and whims,” he stated.

Since Musk acquired the social media platform in 2022, altering its title to X, he has applied sweeping adjustments together with reducing employees and giving “amnesty” to beforehand suspended accounts, together with Trump’s, which had been suspended following the Jan. 6, 2021, Capitol rebellion. Musk has additionally faced widespread criticism from civil rights teams for the amplification of bigotry on the platform.

Musk has publicly endorsed Trump, and was just lately on the marketing campaign path with the previous president. “As you possibly can see, I am not simply MAGA, I am Darkish MAGA,” Musk said at a recent event. The billionaire has raised funds for Republican causes, and Trump has prompt Musk could eventually play a role in his administration if the Republican candidate have been to be reelected.

Throughout his first time period, Trump took a very laborious stance in opposition to journalists, and pursued investigations into leaks from his administration to information organizations. Below Biden, the White Home has been notably more amenable to journalists.

Additionally prime of thoughts for media executives — and authorities officers — is TikTok.

Lawmakers have argued that TikTok’s Chinese language possession may very well be a nationwide safety danger.

Earlier this yr, Biden signed laws that provides Chinese language father or mother ByteDance till January to discover a new proprietor for the platform or face a U.S. ban. TikTok has stated the invoice, the Defending People From International Adversary Managed Purposes Act, which handed with bipartisan help, violates the First Modification. The platform has sued the government to stop a potential ban.

Whereas Trump was in workplace, he tried to ban TikTok by an govt order, however the effort failed. Nevertheless, he has extra just lately switched to supporting the platform, arguing that with out it there’s much less competitors in opposition to Meta’s Fb and different social media.

— Lillian Rizzo and Alex Sherman

Eating places

Each Trump and Harris have endorsed plans to finish taxes on restaurant employees’ suggestions, though how they might achieve this is more likely to differ.

The meals service and restaurant trade is the nation’s second-largest private-sector employer, with 15.5 million jobs, in response to the Nationwide Restaurant Affiliation. Roughly 2.2 million of these workers are tipped servers and bartenders, who might find yourself with extra money of their pockets if their suggestions are not taxed.

Trump’s marketing campaign hasn’t given a lot element on how his administration would eradicate taxes on suggestions, however tax specialists have warned that it might flip right into a loophole for top earners. Claims from the Trump marketing campaign that the Republican candidate is pro-labor have clashed together with his document of appointing leaders to the Nationwide Labor Relations Board who’ve rolled again employee protections.

In the meantime, Harris has stated she’d solely exempt employees who make $75,000 or much less from paying earnings tax on their suggestions, however the cash would nonetheless be topic to taxes towards Social Safety and Medicare, the Washington Post previously reported.

In step with the marketing campaign’s extra labor-friendly strategy, Harris can be pledging to eradicate the tip credit score: In 37 states, employers solely need to pay tipped employees the minimal wage so long as that hourly wage and suggestions add as much as the realm’s pay flooring. Since 1991, the federal pay flooring for tipped wages has been caught at $2.13.

“Within the brief time period, if [restaurants] need to pay increased wages to their waiters, they will have to lift menu costs, which goes to decrease demand,” stated Michael Lynn, a tipping professional and Cornell College professor.

Tech

Whichever candidate comes out forward in November should grapple with the quickly evolving synthetic intelligence sector.

Generative AI is the most important story in tech because the launch of OpenAI’s ChatGPT in late 2022. It presents a conundrum for regulators, as a result of it permits shoppers to simply create textual content and pictures from easy queries, creating privateness and security issues.

Harris has said she and Biden “reject the false selection that means we will both shield the general public or advance innovation.” Final yr, the White Home issued an govt order that led to the formation of the Commerce Division’s U.S. AI Security Institute, which is evaluating AI fashions from OpenAI and Anthropic.

Trump has committed to repealing the manager order.

A second Trump administration may also try to problem a Securities and Change Fee rule that requires corporations to reveal cybersecurity incidents. The White Home said in January that extra transparency “will incentivize company executives to put money into cybersecurity and cyber danger administration.”

Trump’s operating mate, Vance, co-sponsored a bill designed to finish the rule. Andrew Garbarino, the Home Republican who launched an identical bill, has stated the SEC rule will increase cybersecurity danger and overlaps with present regulation on incident reporting.

Additionally at stake within the election is the destiny of dealmaking for tech buyers and executives.

With Lina Khan helming the FTC, the highest tech corporations have been largely thwarted from making large acquisitions, although the Justice Division and European regulators have additionally created hurdles.

Tech transaction quantity peaked at $1.5 trillion in 2021, then plummeted to $544 billion final yr and $465 billion in 2024 as of September, in response to Dealogic.

Many within the tech trade are essential of Khan and wish her to get replaced ought to Harris win in November. In the meantime, Vance, who labored in enterprise capital earlier than getting into politics, said as just lately as February — earlier than he was chosen as Trump’s operating mate — that Khan was “doing a fairly good job.”

Khan, whom Biden nominated in 2021, has challenged Amazon and Meta on antitrust grounds and has stated the FTC will examine AI investments at Alphabet, Amazon and Microsoft.