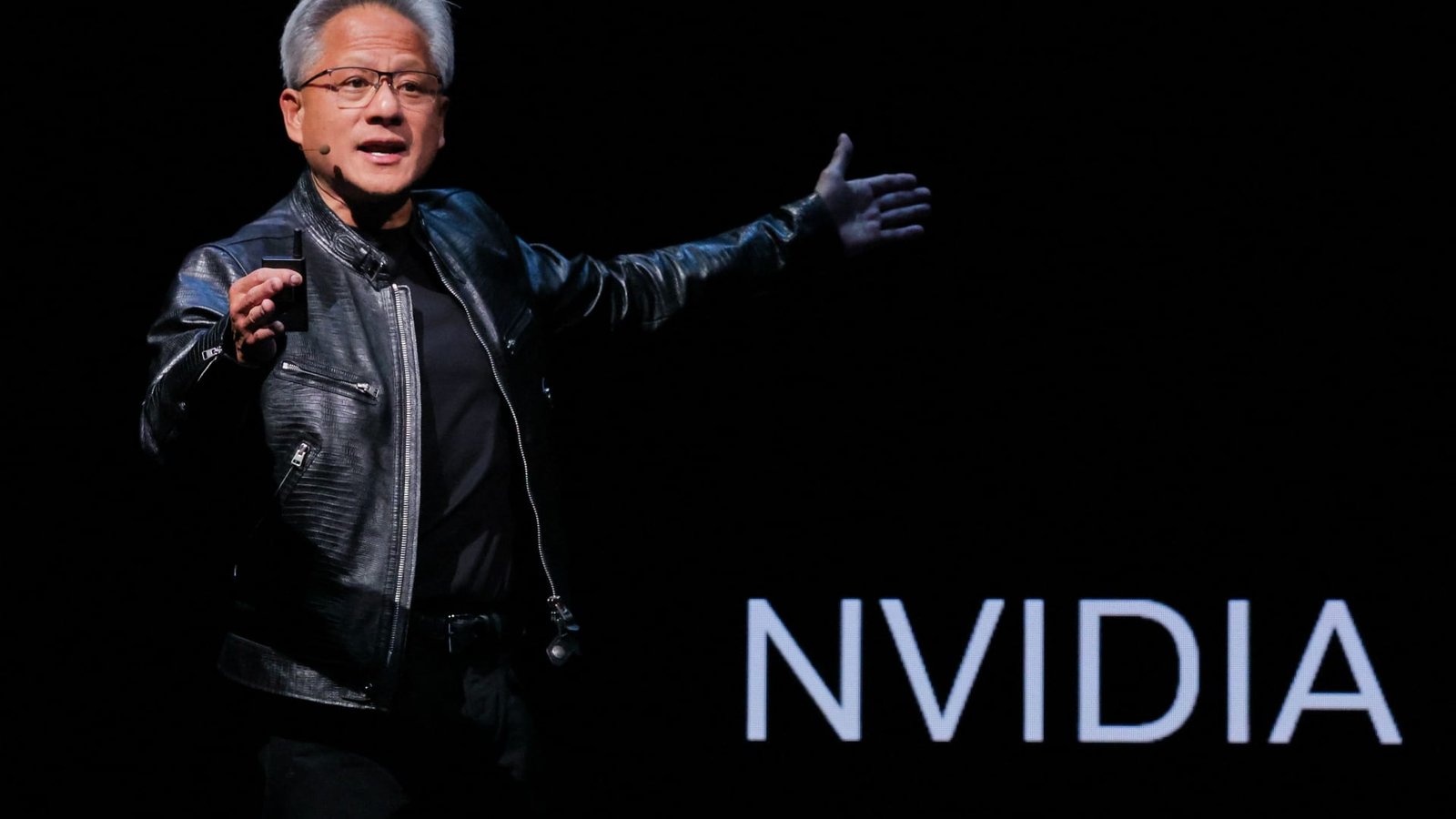

Nvidia CEO Jensen Huang presents the Nvidia Blackwell platform at an occasion forward of the COMPUTEX Discussion board, in Taipei, Taiwan, on June 2, 2024.

Ann Wang | Reuters

Buyers poured into tech shares at one of many quickest clips of the yr a day after the Federal Reserve cut its benchmark interest rate for the primary time since 2020.

Led by a 7.4% achieve in shares of Tesla and a 4% bounce in Nvidia, the Nasdaq rose 2.5% on Thursday, its fourth-sharpest rally of 2024. The largest achieve of the yr for the tech-heavy index was a 3% improve on Feb. 22.

Decrease rates of interest have a tendency to learn tech shares, as a result of decreased borrowing prices and bond yields make dangerous bets extra enticing. Along with the central financial institution’s half-point discount, the Federal Open Market Committee indicated by means of its “dot plot” the equal of fifty extra foundation factors of cuts by the top of the yr, ultimately coming down by 2 proportion factors past Wednesday’s transfer.

Whereas the Nasdaq has been on a gentle rise this yr, powered by Nvidia and the passion round synthetic intelligence, Thursday’s rally pushed the benchmark to its highest since mid-July. The Nasdaq peaked at 18,647.45 on July 10, and it is now simply 3.5% shy of that degree, closing at 18,013.98.

Nvidia, whose processors are powering the generative AI increase and companies like OpenAI’s ChatGPT, gained 4% on Thursday to $117.87. The shares are up about 138% for the yr after greater than tripling in 2023, although they’re nonetheless 13% beneath their all-time excessive reached in June.

Nvidia counts on a comparatively small group of consumers — specifically Microsoft, Meta, Alphabet, Amazon, Oracle and OpenAI — for an outsized quantity of income as a result of these are the businesses both creating giant language fashions, internet hosting large AI workloads or doing each. Any signal of slackening demand creates concern round Nvidia’s inventory.

However decrease charges are seen as one other potential boon.

Fellow chipmakers Advanced Micro Devices and Broadcom additionally rallied large on Thursday, gaining 5.7% and three.9%, respectively. AMD is making an attempt to problem Nvidia within the AI market, but it surely’s far behind and has some skeptics on Wall Avenue. The inventory is barely up about 6% this yr.

AMD CEO Lisa Su advised CNBC’s Jim Cramer on Wednesday that AI is a really lengthy sport, and we’re on the early phases.

“Let’s not be impatient. Tech traits are supposed to play out over years, not over months,” Su mentioned. “We have solely been on this, let’s name it, ChatGPT world for perhaps like 18 months. We’re all studying. It is enjoyable. All of us use it.”

Su mentioned AI goes to make its method into “all facets of our lives,” together with training and drug improvement.

“The fantastic thing about all that is you want the computing, and that is what we do,” Su mentioned.

Tesla was the largest gainer amongst tech’s megacap firms on Thursday, gaining 7.4%. The electrical automobile maker has been a relative laggard for the yr, down nearly 2%, in comparison with the Nasdaq’s 20% achieve. Nevertheless, Tesla is up 72% from its low for the yr in April.

Among the many different high tech firms, Apple and Meta additionally closed with large features, every rising nearly 4%.