Nobel Prize-winning economist Joseph Stiglitz says the Federal Reserve ought to ship a half-point rate of interest minimize at its forthcoming assembly, accusing the U.S. central financial institution of going “too far, too quick” with financial coverage tightening and making the inflation drawback worse.

His feedback come forward of Friday’s pivotal release of U.S. jobs data, with buyers carefully monitoring the August nonfarm payrolls rely for clues on the dimensions of an expected charge minimize this month. The roles information is scheduled out at 8:30 a.m. ET.

Strategists have usually stated that the almost definitely final result from the Fed’s Sept. 17-18 assembly is a 25-basis-point charge minimize, though bets for a 50-basis-point discount have elevated in current days.

A foundation level is 0.01 share level.

Stiglitz, who gained the Nobel Prize in 2001 for his market evaluation, joins the likes of JPMorgan’s chief U.S. economist in calling for a supersized charge minimize this month.

“I have been criticizing the Fed for going too far, too quick,” Stiglitz instructed CNBC’s Steve Sedgwick on Friday on the annual Ambrosetti Discussion board held in Cernobbio, Italy.

Stiglitz stated it was “actually necessary” for the Fed to have normalized rates of interest, including that it was a mistake for the U.S. central financial institution to have held the benchmark borrowing charge close to zero for such a protracted interval since 2008.

“However then they went past that to the place the rates of interest have been, and I assumed that put the financial system in danger for little or no profit, in all probability truly worsening inflation, satirically, as a result of in case you regarded extra fastidiously on the sources of inflation, an enormous element was housing,” Stiglitz stated.

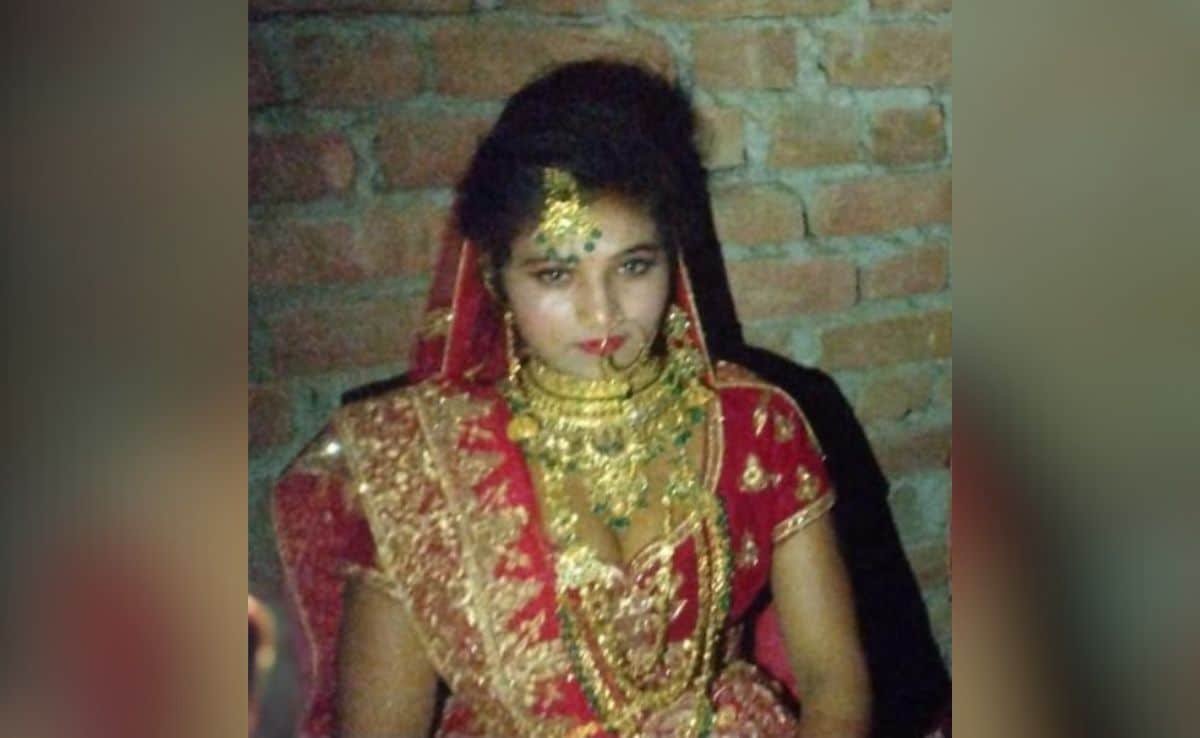

American economist Joseph Stiglitz Economic system Nobel Prize in 2001 attends the Trento Economic system Competition 2023 at Sociale Theater on Could 27, 2023 in Trento, Italy.

Roberto Serra – Iguana Press | Getty Photos Leisure | Getty Photos

“If you concentrate on, how will we cope with the issue of a housing scarcity, which is rising the worth of inflation — do you assume elevating rates of interest making it tougher for actual property builders to construct extra homes, owners to purchase extra homes, goes to resolve the housing scarcity? No, it is entering into precisely the improper approach,” he continued.

“So, I consider that they’ve contributed to the issue of inflation. Now, though their fashions do not work this manner, they usually’re not taking a look at issues, I feel, as deeply as they need to, their fashions inform them [to] take a look at the weaknesses within the financial system, and due to this fact we ought to be decreasing rates of interest.”

The Fed’s benchmark borrowing charge is at the moment focused in a variety between 5.25%-5.5%.

If he have been serving as a Fed policymaker, Stiglitz stated he would vote for a much bigger charge minimize on the central financial institution’s September assembly, “as a result of I feel they went too far, and it might truly assistance on the problem of inflation and on jobs.”

Requested whether or not this meant he believed a 50-basis-point charge minimize ought to be on the desk whatever the August nonfarm payrolls determine, Stiglitz replied: “Sure.”

A spokesperson on the Federal Reserve declined to remark.

Bets rising for a half-point discount

Market individuals are firmly pricing in a charge minimize on the Fed’s subsequent policy-setting assembly, with bets for a half-point discount rising shortly after Wednesday’s release of the report on Job Openings and Labor Turnover Survey, or JOLTS.

The information confirmed that U.S. job openings fell to their lowest degree in in 3½ years in July, in what was seen as one other signal of slack within the labor market.

Merchants are at the moment pricing in a roughly 59% likelihood of a 25-basis-point charge minimize in September, with 41% pricing in a 50-basis-point charge discount, in keeping with the CME Group’s FedWatch Tool. Bets for a 50-basis-point charge minimize stood at 34% simply over per week in the past.

Not everybody says an enormous rate of interest minimize is critical this month.

George Lagarias, chief economist at Forvis Mazars, said that, whereas nobody can assure the dimensions of the Fed’s charge minimize at its September assembly, he’s “firmly” within the camp calling for a quarter-point discount.

“I do not see the urgency for the 50 [basis point] minimize,” Lagarias instructed CNBC’s “Squawk Field Europe” on Thursday.

“The 50 [basis point] minimize would possibly ship a improper message to markets and the financial system. It’d ship a message of urgency, and, you already know, that could possibly be a self-fulfilling prophecy,” he continued.

“So, it might be very harmful in the event that they went there with out a particular motive. Except you might have an occasion, one thing that troubles markets, there isn’t any motive for panic.”