However on this article, let’s deal with earnings technology first.

Three helpful low-risk devices that may are available very useful in earnings technology for senior residents are the Senior Citizen Financial savings Scheme (SCSS), Submit Workplace Month-to-month Earnings Scheme (POMIS) and RBI Floating-Charge Financial savings Bond (FRSB).

Let’s see how these can be utilized collectively to generate earnings.

Senior Citizen Financial savings Scheme: SCSS permits an individual above the age of 60 to take a position as much as ₹30 lakh and generate 8.2% in annual curiosity earnings. This interprets to about ₹2.46 lakh yearly or ₹20,500 month-to-month. A senior citizen couple can collectively earn about ₹41,000 month-to-month in SCSS curiosity earnings if each can park ₹30 lakh every of their particular person SCSS accounts.

Do word that whereas the present charges are excessive at 8.2%, the nice factor is that the speed on the time of constructing SCSS deposit is fastened for the whole tenure of 5 years, despite the fact that SCSS will get reviewed by the federal government. each quarter. The tenure of SCSS is 5 years and one can lengthen it for 3 extra years on the then prevalent charges.

Submit Workplace Month-to-month Earnings Scheme: POMIS is one other secure interest-bearing instrument which permits one to take a position ₹9 lakh per particular person. The present charge of curiosity is 7.4%. So, if the husband and spouse collectively park ₹18 lakh (in two particular person accounts of ₹9 lakh every) in POMIS, then collectively, the senior couple can generate about ₹1.33 lakh yearly or ₹11,100 month-to-month in curiosity earnings. The POMIS too has a tenure of 5 years.

RBI Floating Charge Bonds: The third choice for conservative retirees seeking to generate first rate curiosity earnings is RBI Floating Rate Bonds (RBI FRSB). The present rate of interest on RBI Floating Charge Bonds is 8.05% every year and the bonds have a tenure of seven years. However there’s a small situation. The charges usually are not locked and relatively, ‘float’, because the identify suggests and are reset each 6 months.

There’s a pre-approved and glued system for rate of interest calculation on these Floating Charge Bonds. It’s pegged with the prevailing Nationwide Saving Certificates (NSC) charges with an expansion of 0.35% over the respective NSC charge. The present NSC charges are 7.70% and so, including the +35 foundation factors unfold, we get 8.05% as the speed on RBI FRSBs.

Now isn’t it a threat that FRSB charges float and might go downwards additionally within the close to future? Sure, that could be a particular threat of that occuring. However there’s something in previous NSC charge knowledge that means that the charges could not fall an excessive amount of. The NSC charges since FY 2017-18 have seen the highs of 8.5% and the lows of 6.8%.

So, if the previous is any indication for the longer term, then if we imagine that NSC charges could not fall under 6.8% for not less than the subsequent few years, then FRSBs at 0.35% extra, may be anticipated to provide an inexpensive 7.15% or extra in curiosity.

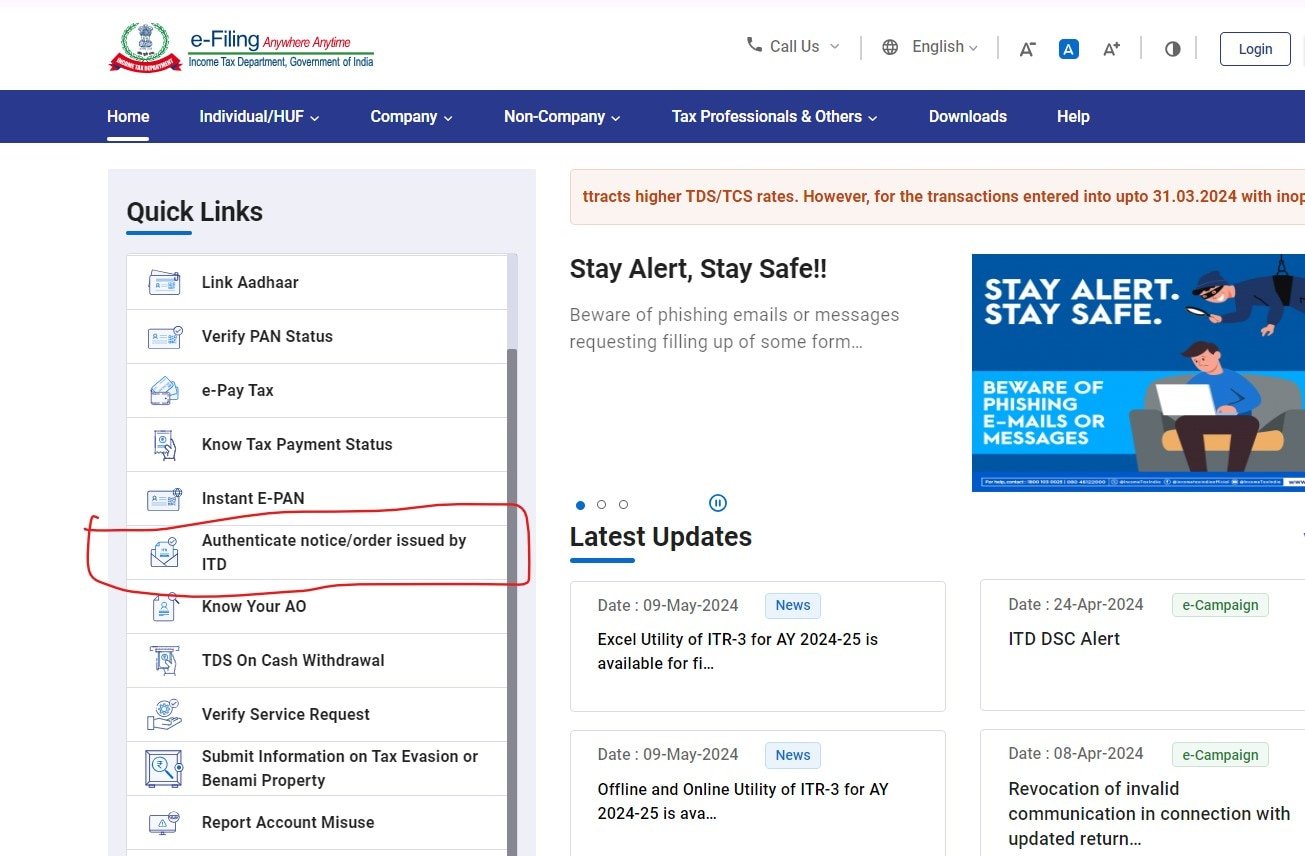

As we noticed above, ₹60 lakh parked in SCSS will generate ₹41,000 month-to-month. ₹18 lakh parked in POMIS will generate ₹11,100 month-to-month. This totals ₹52,000 monthly.

Whether or not it’s sufficient for a retired couple right this moment or not will rely on their way of life, value of residing of their metropolis, medical bills, and so on. However nonetheless, it’s a first rate degree of earnings for a lot of, despite the fact that after a couple of years of inflation, it wouldn’t appear a lot.

Nevertheless, in case extra earnings is required, a proportionate quantity may be parked in FRSBs too to additional generate curiosity earnings. Suppose if ₹1 crore is to be deployed, then ₹60 lakh goes to SCSS, ₹18 lakh goes to POMIS and the remaining ₹22 lakh goes to FRBs. On this case, the approx. month-to-month pre-tax curiosity earnings will probably be about ₹66-67,000.

View Full Picture

The curiosity earnings from all these devices is totally taxable. So, this may be helpful for these in decrease tax brackets.

Word: Lately, financial institution fastened deposits are additionally providing excessive 7-8 p.c to senior residents. So even that may be thought-about so long as one sticks with massive or systemically essential banks.

Make investments some p.c in equities

We noticed how a mix of SCSS, POMIS and FRSBs can assist generate first rate curiosity earnings for the retirees/ senior residents. Nevertheless, provided that these are pure debt devices and provide no capital appreciation (solely curiosity), they won’t be helpful to beat inflation in the long run.

It is for that reason that it’s advisable to park part of the portfolio in equities (or fairness funds). Relying on the scale of the obtainable corpus, threat urge for food and earnings necessities, about 25-35% fairness publicity may be thought-about to increase portfolio longevity.

It will make sure that not less than part of the corpus is working to generate inflation-beating returns.

Dev Ashish is a Sebi-registered funding adviser and the founding father of Steady Investor.

Unlock a world of Advantages! From insightful newsletters to real-time inventory monitoring, breaking information and a customized newsfeed – it is all right here, only a click on away! Login Now!

Obtain The Mint News App to get Every day Market Updates.

Revealed: 15 Could 2024, 12:21 PM IST