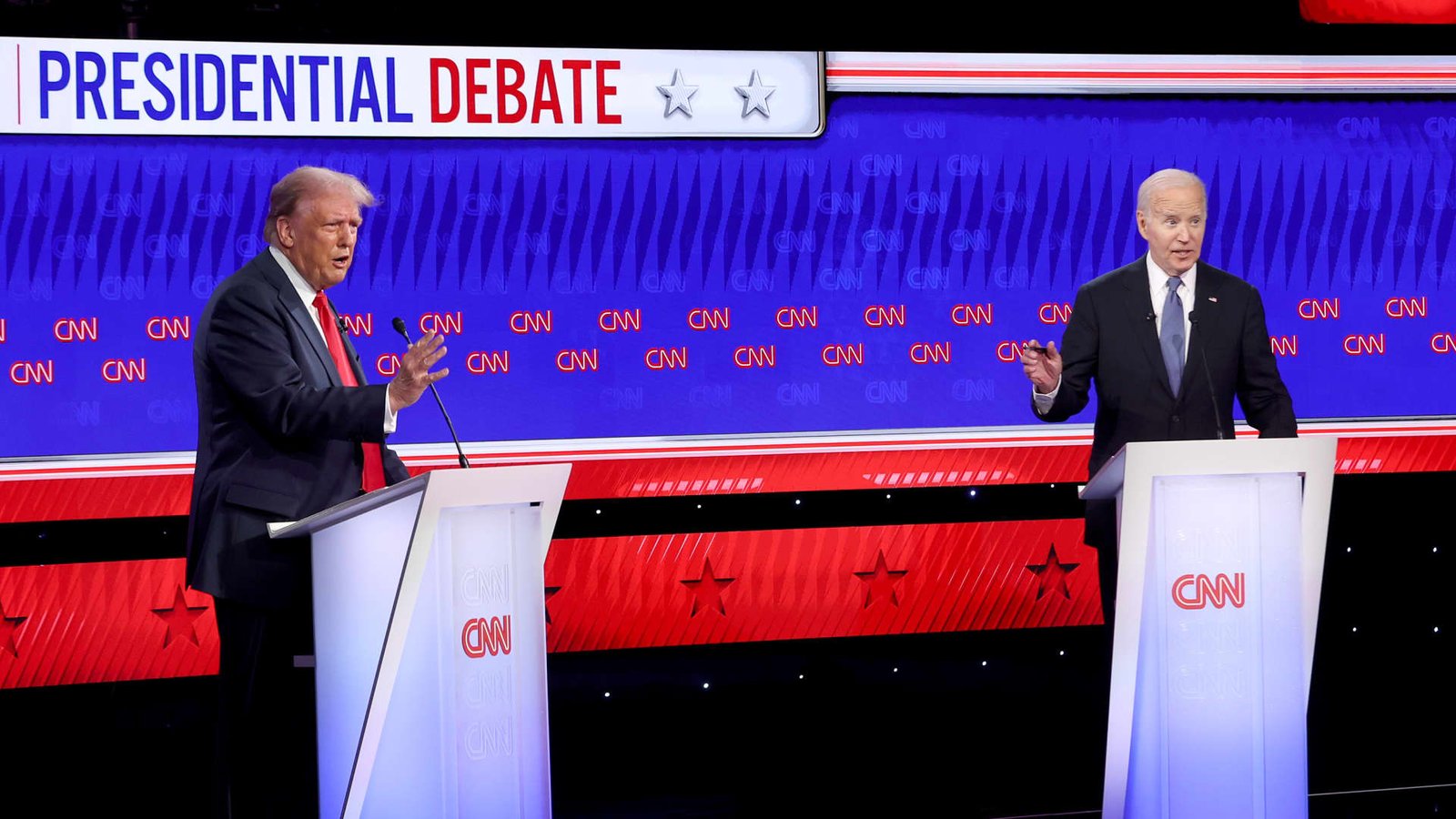

President Joe Biden and former President Donald Trump take part within the CNN Presidential Debate on June 27, 2024 in Atlanta.

Justin Sullivan | Getty Photos Information | Getty Photos

Inflation decelerated again in June, bringing additional reduction to customers’ wallets.

The buyer worth index rose 3% in June 2024 from June 2023, down from a 3.3% annual inflation price in Might, the Bureau of Labor Statistics reported Thursday.

Whereas inflation is not fairly but again to policymakers’ long-term goal round 2%, it has cooled considerably from about 9% two years in the past, the best degree since 1981.

However why did inflation initially take off?

The primary U.S. presidential debate final month noticed each candidates — President Joe Biden and former President Donald Trump — blame one another for inflation-related grievances throughout the pandemic period.

Extra from Private Finance:

Here’s the inflation breakdown for June 2024 — in one chart

Why housing inflation is still stubbornly high

More Americans are struggling even as inflation cools

“He triggered the inflation,” Trump said of Biden throughout the June 27 debate. “I gave him a rustic with no, primarily no inflation,” he added.

Biden countered by saying inflation was low throughout Trump’s time period as a result of the financial system “was flat on its again.”

“He decimated the financial system, completely decimated the financial system,” Biden stated.

However the reason for inflation is not so black and white, economists say.

In truth, Biden and Trump should not chargeable for a lot of the inflation customers have skilled lately, they stated.

‘Neither Trump nor Biden is in charge’

International occasions past Trump’s or Biden’s management wreaked havoc on provide and demand dynamics within the U.S. financial system, fueling larger costs, economists stated.

There have been different components, too.

The Federal Reserve, which acts independently from the Oval Workplace, was sluggish to behave to include scorching inflation, for instance. Some Biden and Trump insurance policies resembling pandemic reduction packages additionally probably performed a job, as may need so-called greedflation.

“I do not assume it is a easy sure/no sort of reply,” stated David Wessel, director of the Hutchins Heart on Fiscal and Financial Coverage on the Brookings Establishment, a left-leaning assume tank.

“Basically, presidents get extra credit score and blame for the financial system than they deserve,” he stated.

That Biden is seen as stoking excessive inflation is due considerably to optics: he took workplace in early 2021, across the time inflation spiked notably, economists stated.

Likewise, the Covid-19 pandemic plunged the U.S. right into a extreme recession throughout Trump’s tenure, pulling the patron worth index to near zero in spring 2020 as unemployment ballooned and customers reduce spending.

“In my opinion, neither Trump nor Biden is in charge for the excessive inflation,” stated Mark Zandi, chief economist at Moody’s Analytics. “The blame goes to the pandemic and the Russian battle in Ukraine.”

The large causes inflation spiked

A terminal on the Qingdao Port on June 20, 2022 in Qingdao, Shandong Province of China.

Wu Shaoyang/VCG through Getty Photos

Inflation has many tentacles. At a excessive degree, scorching inflation is essentially a difficulty of mismatched provide and demand.

The pandemic upended the everyday dynamics. For one, it disrupted international provide chains.

There have been labor shortages: Sickness sidelined employees. Youngster-care facilities closed, making it laborious for fogeys to work. Others have been apprehensive about getting sick on the job. A decline in immigration additionally lowered employee provide, economists stated.

China shut down factories and cargo ships couldn’t be unloaded at ports, for instance, decreasing the provision of products.

In the meantime, customers modified their shopping for patterns.

They purchased extra bodily stuff resembling front room furnishings and desks for his or her dwelling workplaces as they spent extra time indoors — a departure from pre-pandemic norms, when Individuals tended to spend more money on services resembling eating out, journey, and going to films and live shows.

Excessive demand, which boomed when the U.S. financial system reopened broadly, coupled with items shortages fueled larger costs.

There have been different associated components, too.

For instance, automakers did not have sufficient semiconductor chips crucial to construct automobiles, whereas rental automobile corporations bought off their fleets as a result of they did not assume the recession can be short-lived, making it pricier to lease when the financial system rebounded rapidly, Wessel stated.

As Covid instances have been hitting record highs heading into 2022, additional disrupting provide chains, Russia’s battle in Ukraine “supercharged” inflation by stoking larger costs for commodities resembling oil and meals around the globe, Zandi stated.

In consequence, international inflation hit a degree “larger than seen in a number of a long time,” the Worldwide Financial Fund wrote in October 2022.

“We solely have to take a look at the nonetheless excessive inflation charges in most different superior economies to see that almost all of this inflation interval was actually about international tendencies … somewhat than concerning the particular coverage actions of any given authorities (although they did after all play some position),” Stephen Brown, deputy chief North America economist at Capital Economics, wrote in an electronic mail.

Large spending payments’ influence ‘solely clear in hindsight’

US President Joe Biden speaks throughout remarks on the implementation of the American Rescue Plan in Washington on March 15, 2021.

Eric Baradat | Afp | Getty Photos

Nevertheless, Biden and Trump aren’t solely with out fault: They greenlit further authorities spending within the pandemic period that contributed to inflation, for instance, economists stated.

For instance, the American Rescue Plan — the $1.9 trillion stimulus package Biden signed in March 2021— provided $1,400 stimulus checks, enhanced unemployment advantages and a bigger youngster tax credit score to households, along with different reduction.

The coverage led to “some good issues,” resembling a powerful job market and low unemployment, stated Michael Pressure, director of financial coverage research on the American Enterprise Institute, a right-leaning assume tank.

However its magnitude was larger than the U.S. financial system wanted on the time, serving to boost costs by placing extra money in customers’ pockets, which fueled demand, he stated.

“I do assume President Biden bears some accountability for the inflation that we have been dwelling by means of for the previous few years,” Pressure stated.

He estimated the American Rescue Plan added about 2 proportion factors to underlying inflation. The buyer worth index peaked at 9.1% in June 2022, the best since 1981. It is since declined to three%.

The Federal Reserve — the U.S. central financial institution — goals for a long-term inflation price close to 2%.

“I believe if it weren’t for the American Rescue Plan, the U.S. nonetheless would have had inflation,” Pressure added. “So I believe it is essential to not overstate the scenario.”

Nevertheless, Zandi considered the ARP’s inflationary influence as “good” and “fascinating,” bringing the financial system again to the Fed’s long-term goal inflation price after a chronic interval of below-average inflation.

Trump had additionally licensed two stimulus packages, in March and December 2020, value about $3 trillion.

These so-called fiscal coverage responses have been insurance coverage in opposition to a awful financial restoration, maybe overshooting after the lackluster U.S. response to the Nice Recession that mired the nation in excessive unemployment for years, Wessel stated.

That the U.S. issued maybe an excessive amount of stimulus was the presidents’ fault however “solely clear in hindsight,” he stated.

Biden and Trump additionally enacted different insurance policies that will contribute to larger costs, economists stated.

For instance, Trump imposed tariffs on imported metal, aluminum and a number of other items from China, which Biden largely saved intact. Biden additionally set new import taxes on Chinese language items resembling electrical automobiles and photo voltaic panels.

The Fed and ‘greedflation’

U.S. Federal Reserve Chair Jerome Powell speaks at a information convention on rates of interest, the financial system and financial coverage actions on June 15, 2022.

Olivier Douliery- | Afp | Getty Photos

Fed officers even have some accountability for inflation, economists stated.

The central financial institution makes use of rates of interest to regulate inflation. Rising charges raises borrowing costs for businesses and consumers, cooling the financial system and due to this fact inflation.

The Fed has raised charges to their highest in about 20 years, however was initially sluggish to behave, economists stated. It first elevated them in March 2022, a couple of yr after inflation began to spike.

It additionally waited too lengthy to throttle again on “quantitative easing,” Pressure stated, a bond-buying program meant to stimulate financial exercise.

“That was a mistake,” Zandi stated of Fed coverage. “I do not assume anybody would have gotten it proper given the circumstance, however in hindsight it was an error.”

Some observers have additionally pointed to so-called greedflation — the notion of companies making the most of the high-inflation narrative to boost costs greater than wanted, thereby boosting earnings — as a contributing issue.

It is unlikely this was a reason behind inflation, although it might have contributed barely, economists stated.

“To the extent something like that occurred — which I am undecided it did — this might be a really minor issue within the inflation we had,” stated Pressure. He estimates the dynamic would have added effectively lower than 1 proportion level to the inflation price.

“Corporations all the time search for a chance to boost costs once they can,” Wessel stated. “I believe they took benefit of the inflationary local weather, however I do not assume they triggered it.”