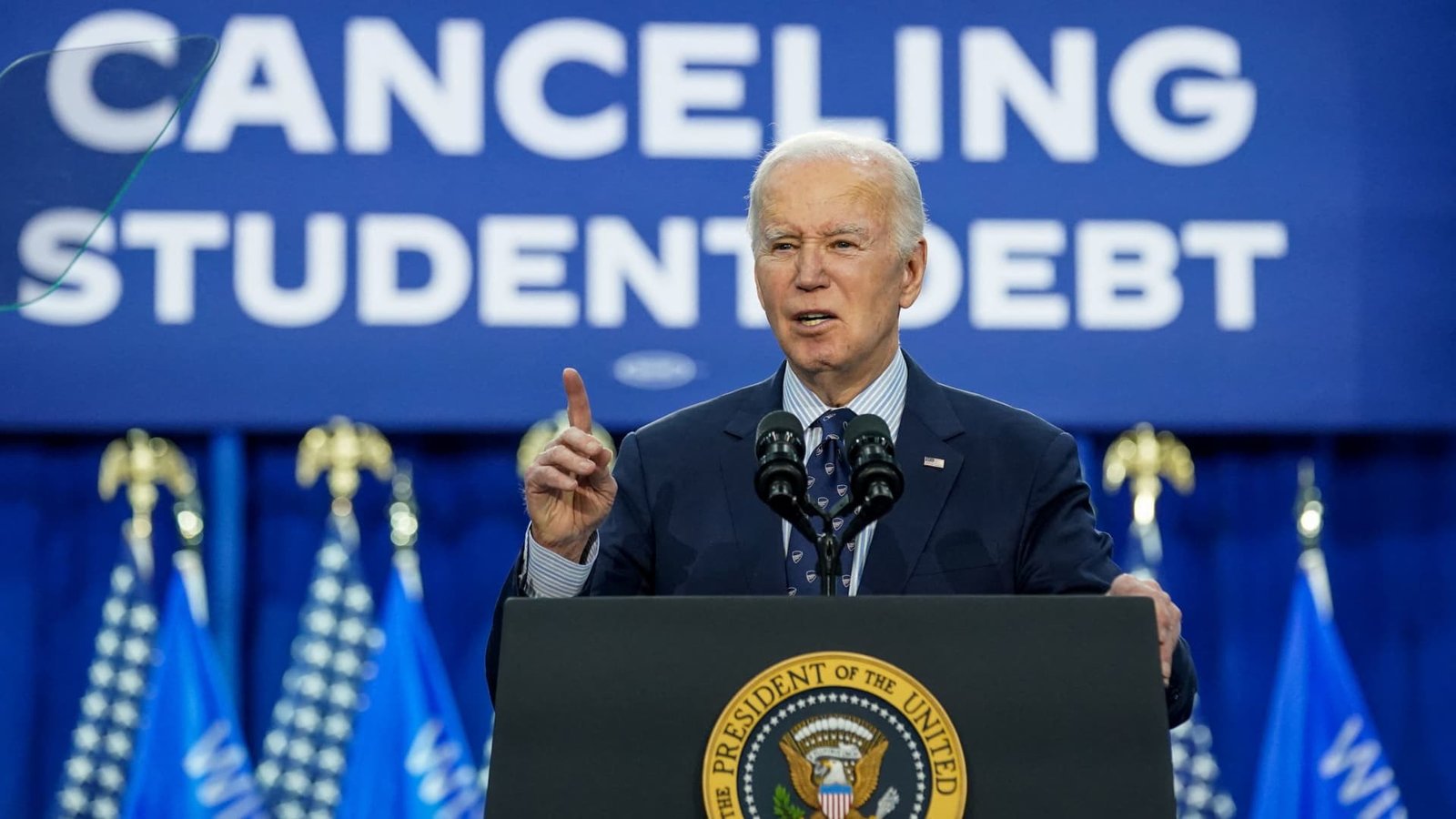

U.S. President Joe Biden is joined by Training Secretary Miguel Cardona (L) as he proclaims new actions to guard debtors after the Supreme Courtroom struck down his scholar mortgage forgiveness plan within the Roosevelt Room on the White Home on June 30, 2023 in Washington, DC.

Chip Somodevilla | Getty Photographs Information | Getty Photographs

Cody Gude was counting the seconds till July when his month-to-month student loan fee was scheduled to drop to $100 from $200.

The decrease fee meant that he would not must ship groceries on Instacart in his spare time, on high of his work as a social media guide.

“I might breathe,” the 35-year-old Tampa resident mentioned.

However then he noticed headlines on Monday that main components of the Saving on a Useful Training, or SAVE, plan had been on pause. Two federal judges in Kansas and Missouri quickly halted the Biden administration’s new compensation plan till they rule on the circumstances.

The U.S. Division of Justice is expected to appeal the preliminary injunctions, however for now, hundreds of thousands of scholar mortgage debtors are disillusioned and indignant that they will not see the aid they anticipated in only a matter of days.

Extra from Private Finance:

Why inflation is still upending retirement plans

Older voters want candidates who will protect Social Security

Workers in certain industries tend to have higher 401(k) balances

There’s a substantial amount of confusion as effectively.

Gude’s scholar mortgage servicer, Nelnet, already up to date his month-to-month invoice to replicate the decrease quantity. (Below SAVE, many debtors pay simply 5% of their discretionary earnings towards their debt every month as a substitute of the earlier 10% requirement, and hundreds of thousands of debtors have a $0 monthly payment.)

“So am I truly going to have that fee, or are they going to ship me a letter saying, ‘Ha! We’re simply kidding,'” Gude mentioned. “Everyone seems to be in the dead of night.”

Here is what we all know up to now.

Why is the SAVE plan inflicting drama?

President Joe Biden last summer rolled out the SAVE plan, describing it as “essentially the most inexpensive scholar mortgage plan ever.” To this point, round 8 million borrowers have signed up for the brand new income-driven compensation plan, in keeping with the White Home.

Below IDR plans, debtors pay a share of their discretionary earnings every month and obtain forgiveness after a set interval, usually 20 years or 25 years. SAVE changed the U.S. Division of Training’s former REPAYE choice, or Revised Pay As You Earn plan.

The SAVE plan has essentially the most beneficiant phrases so far, which has led to the present controversy.

As a substitute of paying 10% of their discretionary earnings a month towards their undergraduate scholar debt beneath REPAYE, debtors must pay simply 5%.

Those that earn lower than $15 an hour have a $0 month-to-month invoice, and debtors with smaller balances are entitled to mortgage forgiveness in as little as 10 years.

“The SAVE plan could be very beneficiant to debtors, nearly like a grant after the actual fact,” mentioned increased training knowledgeable Mark Kantrowitz.

As a result of timeline of regulatory adjustments, the SAVE plan wasn’t scheduled to completely take impact till July 1, though some options had been already obtainable to debtors.

By mid-April, 360,000 debtors acquired $4.8 billion in debt aid beneath the plan, the Training Division reported.

What did the judges resolve?

The federal judges responded to lawsuits in opposition to the SAVE plan filed earlier this yr by Republican-led states, together with Florida, Arkansas and Missouri.

The states argued that the Biden administration was overstepping its authority with SAVE, and basically looking for a roundabout strategy to forgive scholar debt after the Supreme Courtroom blocked its sweeping plan final yr.

The federal decide in Kansas, Daniel Crabtree, declined to unwind options of the SAVE plan already in impact “as a result of plaintiffs have did not exhibit these provisions triggered irreparable hurt” since they’d introduced the lawsuit “lengthy after defendants already had carried out these facets of the SAVE Plan.”

Nevertheless, Crabtree agreed to halt the Training Division from implementing the SAVE provision that dramatically lowers debtors’ month-to-month funds come July. Crabtree identified that the REPAYE plan, which SAVE changed, “value an estimated $15.4 billion.” The SAVE plan, in the meantime, is predicted to value $475 billion over the subsequent decade.

“This distinction — $475 billion versus $15.4 billion — expands company authority to such an extent that it alters it,” Crabtree wrote. “So, the courtroom concludes that the SAVE Plan represents ‘an unlimited and transformative growth in regulatory authority with out clear congressional authorization.'”

In the meantime in Missouri, Decide John Ross prevented the Biden administration from forgiving any extra scholar debt beneath the SAVE program till he reaches a choice on the case. Ross agreed with the states that the aid plan would seemingly scale back the charges the federal government pays to the Missouri Greater Training Help Company, or Mohela, for servicing its federal scholar loans.

So, the important thing query is: How lengthy can this authorized case take?

“Months, I believe, previous [the] election,” mentioned Scott Buchanan, govt director of the Pupil Mortgage Servicing Alliance, a commerce group for federal scholar mortgage servicers.

Buchanan assumes the circumstances will finally attain the Supreme Courtroom, “then they themselves would not even take it up till the October time period, for a ruling a lot later.”

Within the meantime, what do debtors do?

Debtors can keep enrolled within the SAVE plan for now, and plenty of are nonetheless benefiting from decrease payments already. (The judges did not pause the availability shielding the next share of debtors’ earnings from their fee calculation.)

Even when your servicer up to date your month-to-month invoice to what it was going to be earlier than the preliminary injunctions, your required fee ought to quickly revert again to its June degree, specialists say.

“The courtroom’s ruling isn’t retroactive,” Kantrowitz added. “So, debtors don’t have to fret concerning the courts clawing again the forgiveness they’ve already acquired.”