Gold’s attract has captivated people for millennia. The earliest recorded use dates again to 4000 BC, and by 1500 BC, it had turn out to be the usual medium of worldwide commerce. This affiliation with cash has continued, although gold cash are not official currencies.

Central banks worldwide proceed to carry a good portion of their liquid reserves in gold. In reality, 2022 noticed a 7-decade excessive of 1,081.9 tonnes bought by central banks, with 2023 purchase solely barely decrease at 1,037.4 tonnes. This robust demand is one purpose why gold costs have surged just lately, rising roughly 20% over the previous 12 months.

Additionally Learn: Planning to invest in gold as an asset class? This is how the taxation works

Rising markets drive gold demand

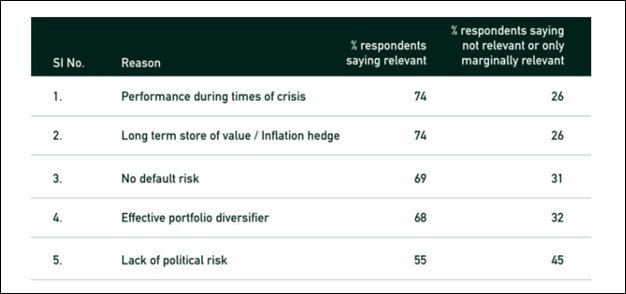

The overwhelming majority of purchases throughout 2022 and 2023 have continued to return from rising market central banks. A World Gold Council survey, amongst Central Banks from each superior and rising markets, relating to elements affecting the Central financial institution’s resolution to carry gold, throws gentle on the attainable the explanation why Central Banks, particularly from rising markets, are shopping for a lot gold.

View Full Picture

Components contributing to gold value rise

Rate of interest coverage: Historically, there was an inverse relationship between gold costs and rates of interest, that means that when rates of interest rise, gold costs are likely to fall, and vice versa. In its current coverage assembly, the Fed had indicated for no less than 3 price cuts price cuts in 2024. So easing financial coverage by the US Federal reserve is one other contributing issue to the current gold value rise.

World uncertainty: 2024 is poised to see elections in additional than 64 international locations which brings in a variety of uncertainty within the markets. And through unsure occasions, buyers flock in direction of security. Therefore, gold turns into a pure possibility for them.

Geopolitical points: To not point out, the collection of geopolitical points within the center East and Russia that we have now been observing which once more sends shock waves to the investor neighborhood and nudges them in direction of security.

Additionally Learn: 5 reasons why gold ETF is better than physical gold for uncertain times

The case for gold as an asset class

Gold is a protected haven asset class. When there may be turmoil out there as a consequence of macro occasions and fairness markets are going through a variety of volatility, gold as an asset class tends to do nicely. Therefore it’s an efficient hedge towards equities. Hedging is a method employed to scale back the chance of hostile value actions in an asset. The method helps mitigate the losses in an asset / instrument by positive aspects in one other funding. This helps navigate market correction.

The beneath desk compares efficiency of gold towards Nifty 500 efficiency throughout occasions of disaster.

View Full Picture

Gold as a hedge towards inflation

Inflation is the speed of enhance or lower in costs over a selected time frame. It signifies how far more costly or cheaper a specific set of products and providers has turn out to be over a sure interval, like 1 / 4 or a 12 months. Traditionally, inflation has impacted returns on fairness and gold in several methods. Excessive inflation has typically correlated with decrease fairness returns. Then again, over the long run, gold acts as an environment friendly hedge towards inflation.

The beneath desk illustrates the efficiency of Nifty 500 and gold during times of accelerating inflation. We now have thought of wholesale value inflation for the aim of the beneath evaluation.

View Full Picture

Constructing a balanced portfolio with gold

A portfolio that features each fairness and gold is an environment friendly solution to obtain capital safety and create wealth in a sustainable trend. The efficiency of gold will offset the poor efficiency of equities throughout unfavourable macro occasions or persistently excessive inflation.

Additionally Learn: Sovereign Gold Bonds: From advantages to eligibility; all you need to know

We now have explored this concept within the beneath desk. The desk beneath explores the efficiency of equities and gold individually and as an fairness weighted portfolio. As seen beneath, the portfolio does higher than each standalone fairness and gold with regards to producing larger danger adjusted returns over the medium to long run.

View Full Picture

There are totally different avenues by way of which one can take publicity to gold. Barring shopping for bodily gold (which isn’t all the time a possible possibility), buyers may put money into gold by way of ETFs and Sovereign Gold Bonds (SGBs).

Final however not the least, you will need to perceive that within the context of portfolio constructing, gold needs to be seen as a diversification software and never an funding that can fetch excessive returns. Therefore averaging the value is not going to work when costs are rising and allocation to the yellow steel shouldn’t exceed 10-15% of the portfolio.

Naveen KR, smallcase Supervisor and Senior Director at Windmill Capital

Unlock a world of Advantages! From insightful newsletters to real-time inventory monitoring, breaking information and a personalised newsfeed – it is all right here, only a click on away! Login Now!

Obtain The Mint News App to get Day by day Market Updates.

Printed: 16 Could 2024, 11:45 AM IST