The monetary 12 months 2023-24 culminated precisely 45 days in the past and the final date to file revenue tax return (ITR) of July 31 is 75 days forward. Though you continue to have ample time to get your act collectively and file your return at a later stage, that is excessive time for a person taxpayer to no less than start the revenue tax e-filing course of.

And earlier than you are taking a plunge into the method, you possibly can undergo a few of the key factors that are important to know beforehand. Listed here are key issues to know for taxpayer beforehand:

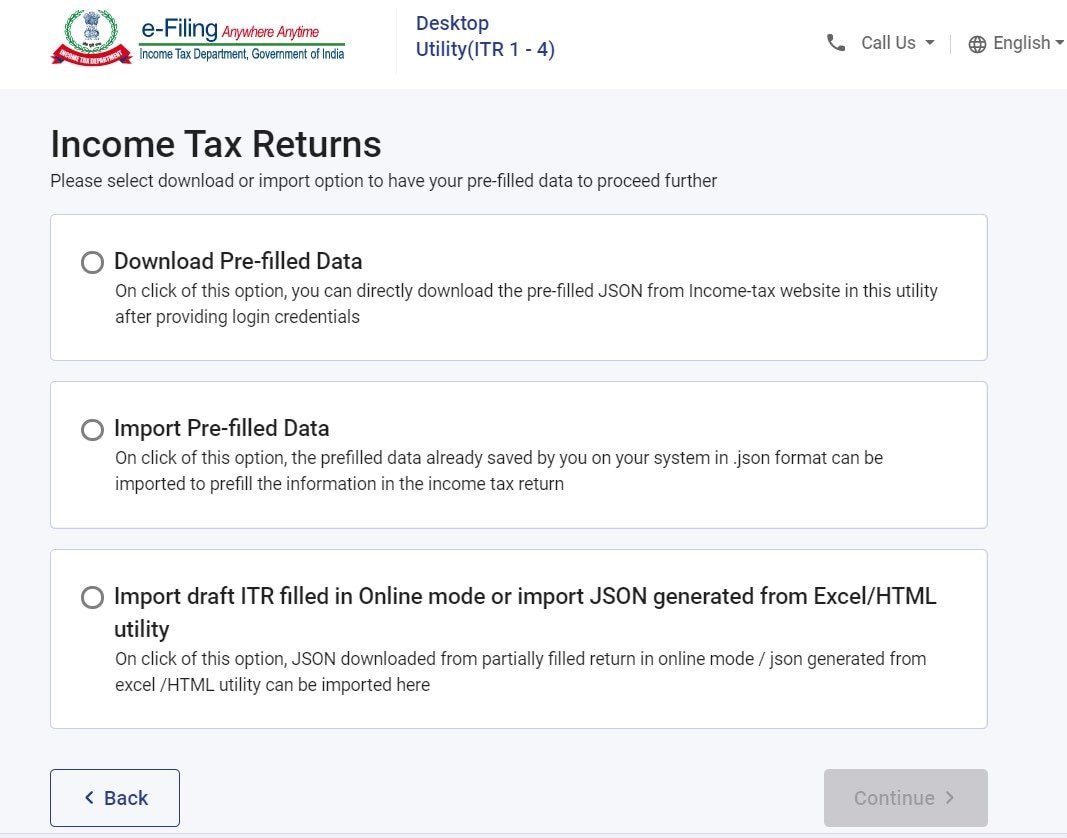

1. Kinds launched: The revenue tax division has launched all of the related ITR forms and can be found for taxpayers to fill them on-line. There’s a provision of e-filing arrange which you’ll obtain in your laptop. It additionally lets you obtain the pre-filled knowledge.

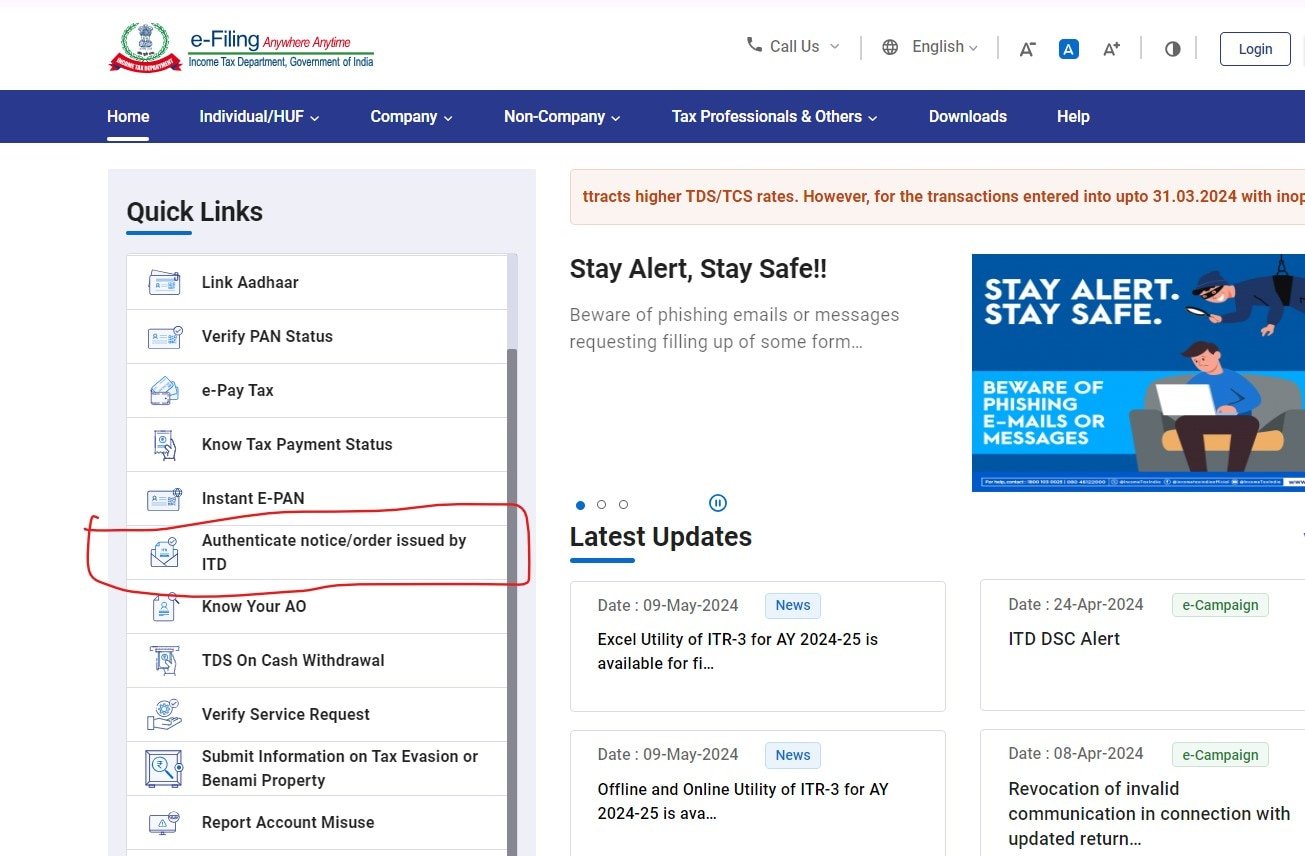

The e-filing utility which you’ll obtain in your laptop provides you three obtain or import choices.

A. Obtain pre-filled knowledge

B. Import pre-filled knowledge

C. Import draft ITR crammed in on-line mode as proven within the picture under

View Full Picture

2. Select kind fastidiously: In the meantime, it’s fairly important to decide on the revenue tax kind fastidiously. As an illustration, whereas ITR-1 is supposed for taxpayers having complete revenue as much as ₹50 lakh from salaries, one home property, different sources and agri revenue as much as ₹5,000 whereas in case your revenue is coming from earnings and positive factors of enterprise or occupation, you’ll want to go for ITR-3.

Moreover, in case you are in a enterprise or occupation and your revenue which is as much as ₹50 lakh is computed beneath presumptive tax provisions of 44AD, 44ADA or 44AE, you possibly can fill ITR-4.

ALSO READ | Income Tax: As ITR forms enabled to file returns, check here which form you would require

3. Tax regime: It’s vital to notice you must particularly go for the outdated tax regime if you wish to avail a few of the exemptions lacking within the new tax regime. Because the new tax regime is the default regime, one has to go for the outdated regime if you wish to pay tax based on these provisions.

4. Calculator: You’ll be able to even use the revenue tax calculator on the revenue tax division web site to compute your actual tax primarily based on the newest provisions. The calculator could be accessed here.

Moreover, you possibly can fill in your revenue particulars to determine which regime is extra helpful to you through the use of one other calculator which could be accessed here that offers a comparative evaluation between the 2 tax regimes.

ALSO READ | Income Tax: Want to opt out of the new tax regime? Here is a step-by-step guide

5. Exemptions: One other salient characteristic which taxpayers have to be conscious of is that they will avail revenue tax exemptions provided that they invested in these tax-saving devices earlier than March 31, 2024.

Any funding made after this deadline cannot be thought of to avail exemptions whereas submitting revenue tax return for FY 2023-24.

Unlock a world of Advantages! From insightful newsletters to real-time inventory monitoring, breaking information and a personalised newsfeed – it is all right here, only a click on away! Login Now!

Obtain The Mint News App to get Each day Market Updates.

Revealed: 15 Could 2024, 10:55 AM IST